A 2024 Federal Arrange Bank examination unmasked that 32% of small corporations offered credit accessibility as their top challenge. Credit accessibility was also noted as the principal matter among Black-owned corporations. Not merely are such corporations the lifeblood of therefore many communities, but they also depend on credit to maintain their operations and grow.

Consider that corporations with five or fewer employees presently accounted for 54% of all corporations in the U.S. in 2018. Among microbusinesses shaped after the pandemic, 26% were Black-owned, and women held 57%. While diversification in business ownership appears encouraging, a closer look at capital distribution numbers shows a challenge: the existing financing ecosystem wasn’t collected to serve these small corporations or historically underserved communities.

Inequality in business financing is not only incredibly frustrating; it takes the situation of the economy. Based on estimates done by Citi in 2020, economic inequality has cost U.S. corporations $16 trillion within the last two decades. Envision the prospect of small corporations if we can change these numbers.

The Broad Benefits Of Quest Tech

Across the mission, technology fuels initiatives that reach more borrowers who might not be offered otherwise. Like, my company’s spouse, Dream spring, adopted an online PPP financing software connected to third-party gateways to get information and more effectively underwrite, process and send documents to the SBA.

Corner Water Bank, a small New Jersey economic institution, also leveraged technology to implement an automatic program through PPP rapidly, letting more purposes be refined rapidly for PPP funds to be seen by small businesses. Corner River’s pace eventually helped them reach more small corporations than some more significant national competitors.

At Lendio, our technology fuses mission-driven financing with advanced fintech abilities to help smaller lenders grow their support of underserved borrowers. This makes capital available to more company owners and allows us to offer scalable solutions for distributing money, which gives voice to many corporations in need.

Please make no mistake; mission technology is not philanthropy: it’s innovative business. This work supports excellent advantages for business owners and economic institutions, communities, and our economy.

New business purposes hit an archive full of 2024 at 5.4 million, and the previous history was collected just a year prior. This takes its quickly rising and increasingly profitable new market. Selecting to raise business owners can give lenders use of a revenue-producing, growth-accelerating market.

What Makes Quest Tech Profitable For Banks And Lenders

The concept is not to boost financing to small corporations at the expense of lenders or banks. Rather the contrary: It simply permits development, increases lender performance and mitigates risk by combining the most effective elements of fintech (speed, adaptability, reach and access) with the assets of economic institutions. Such relationships can offer enormous advantages for banks and lenders as well.

We found mission tech’s promise in action all through pandemic shutdowns when PPP loans were the sole company financing still happening. At the start of the situation, community lenders can serve their business clients: those who had recognized banking associations using them before PPP initiatives. The remaining a lot of small corporations are out of luck.

To repair this, my organization responded by changing our technology and partnering with 320 economic institutions — including large banks, local lenders, and community development financial institutions (CDFIs). For all of us, mission technology helped facilitate $10 billion in business loans to more than 200,000 small businesses.

Quest Tech At Perform: A Several Models To Consider

The need for increased use of capital for small corporations can be as solid as right now. At the same time frame, lenders want to influence their harmony sheets. Technology will help connect the gap.

A few mission-driven economic institutions my organization has partnered with are Texas National Bank (TNB), Dream spring, Accion Prospect Fund and Camino Financial. These partnerships have permitted our associates to implement our technology into the tiny company software sourcing and curation processes.

As a CDFI, TNB’s mission is to allow small corporations to use capital. Our technology will enable them to do this on a more substantial scale. In addition, it permits the review and underwriting of a more significant quantity of documents. It helps TNB reach more corporations, letting the bank scale and process purposes faster and more efficiently. These relationships are not just rendering it more cost-effective for lenders to guide small corporations but also empowering lenders to extend credit sustainably.

Camino Financial, another spouse, is a neo-CDFI based in Los Angeles that is targeted on financing to underbanked corporations, specifically in the Latino community. Both TNB and Camino can better serve their customer’s thanks to their increased reach, faster approvals and a procedure that matches better with the little company owner.

Partnerships such as, for example, these may support discovering the economic energy within small corporations to grow their operations, generate more revenue and produce extra jobs. Consequently, small corporations raise their participation in the ecosystem and can transform into more attractive customers for lenders.

The Most readily useful Of All Worlds

Just like mission technology can allow small corporations to have the capital they want, it can also support lenders raise the whole total addressable industry (TAM) they service. This gifts an immense development opportunity for lenders constantly challenged to find development avenues in an aggressive market.

Quest technology grants lenders the use of client portions and risk pages that they have historically shied away from because of the hefty underwriting fees and bad gain margins. This permits the growth of goal markets.

Any time you construct techniques that concentrate on the customer, additionally, you serve your corporate needs. Quest tech’s method isn’t any exception. In satisfying a mission for business owners, economic institutions and fintech, mission technology may demonstrate a truly lucrative model with advantages for both stakeholders and communities at large.

Entertainment4 years ago

Entertainment4 years ago

Sports4 years ago

Sports4 years ago

Fashion4 years ago

Fashion4 years ago

Business4 years ago

Business4 years ago

Fashion4 years ago

Fashion4 years ago

Business4 years ago

Business4 years ago

Entertainment3 years ago

Entertainment3 years ago

Business4 years ago

Business4 years ago

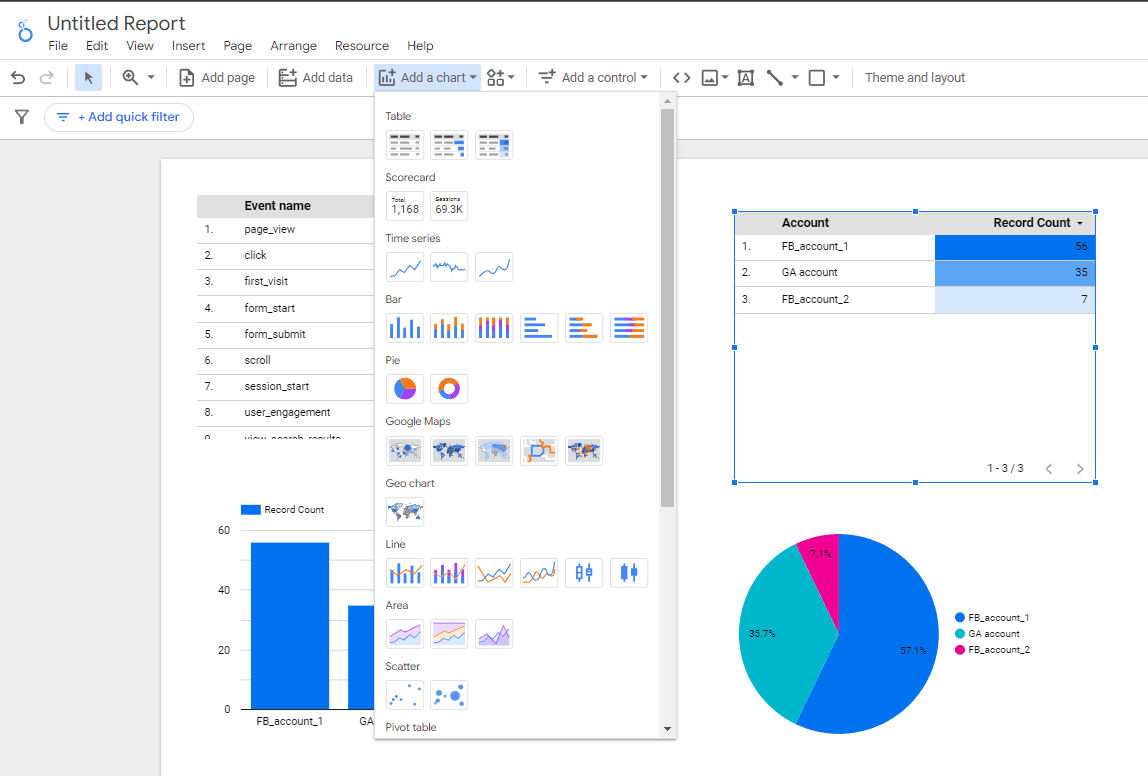

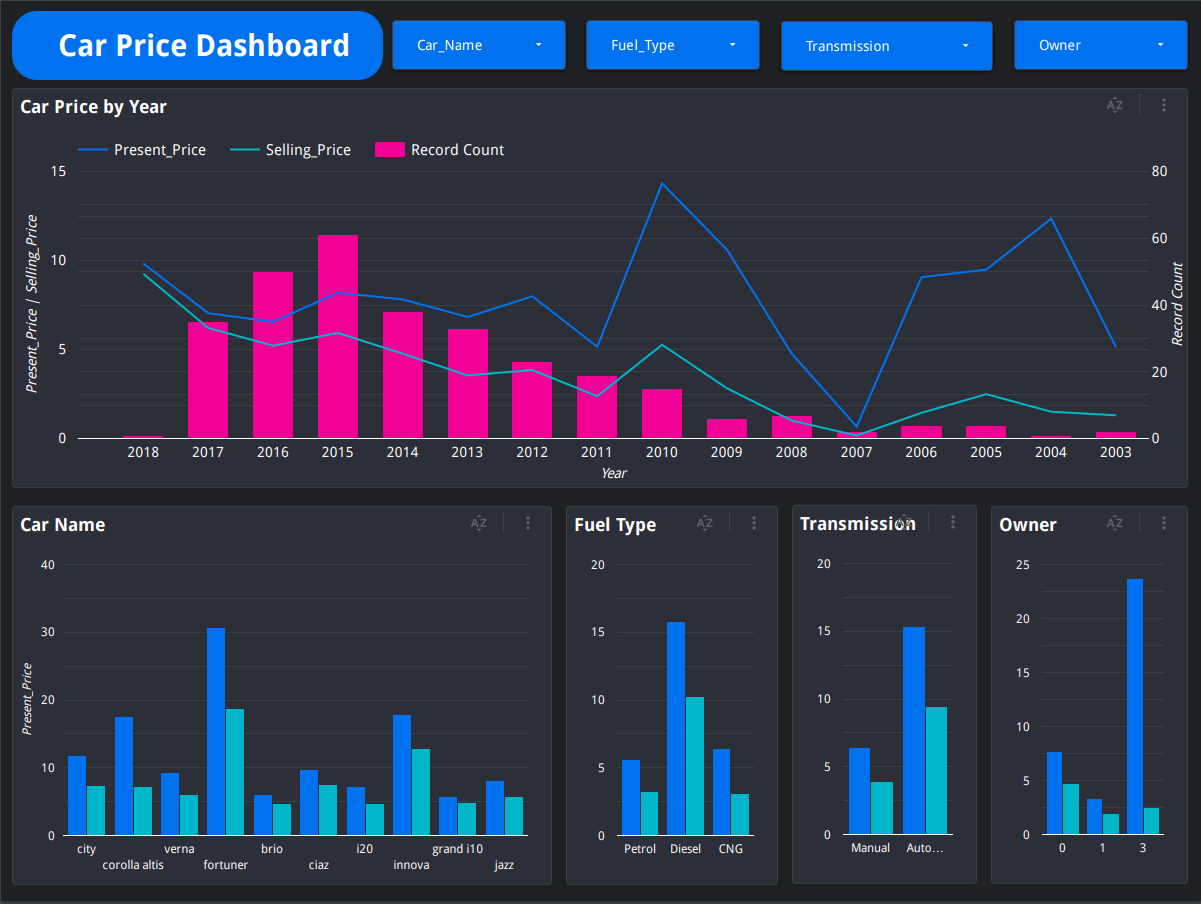

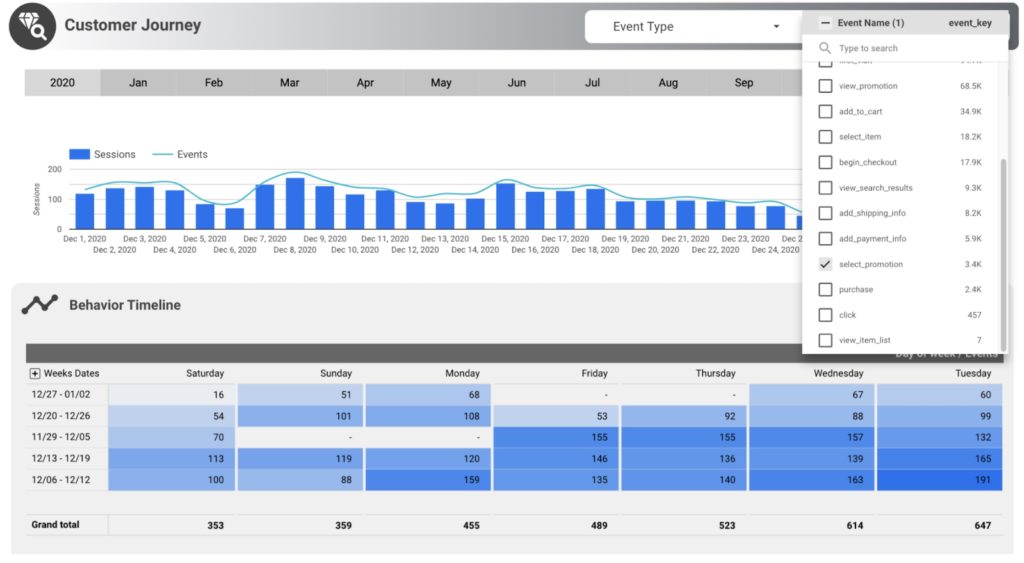

Setting up your Looker Studio workspace is the first step towards optimizing your data analysis workflow. Start by customizing your dashboard layout to fit your needs, whether you prefer a grid layout or a more freeform design.

Setting up your Looker Studio workspace is the first step towards optimizing your data analysis workflow. Start by customizing your dashboard layout to fit your needs, whether you prefer a grid layout or a more freeform design. hen diving into Looker Studio for the first time, it can be overwhelming trying to figure out where to start.

hen diving into Looker Studio for the first time, it can be overwhelming trying to figure out where to start. Creating stunning dashboards and reports in Looker Studio can seem like a daunting task for beginners, but with the right tips and tricks, you can easily master this powerful data visualization tool. Start by carefully selecting the data sources you want to include and organizing them logically.

Creating stunning dashboards and reports in Looker Studio can seem like a daunting task for beginners, but with the right tips and tricks, you can easily master this powerful data visualization tool. Start by carefully selecting the data sources you want to include and organizing them logically. In conclusion, Looker Studio offers a variety of features and functionalities that can help beginners get started on their data analytics journey.

In conclusion, Looker Studio offers a variety of features and functionalities that can help beginners get started on their data analytics journey.